Remodeling my own home (not investment) and receipts

by Erica

(Oakland, CA)

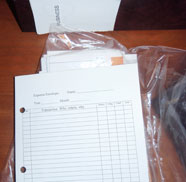

Receipt Ledger Envelope

I remodeled my own home almost ten years ago. I spent a great deal of money and my contractor at the time told me to keep may receipts because he thought I would be able to deduct them at some point......

Do I need to keep all of these receipts and if so for what in particular. Once again, I am living in this home and do not plan on selling in the foreseeable future.

Thanks so much?

Answer by Joe Trometer:

Why Save Your Receipts on a Remodeled House

even if it's not an investment house?

Home Remodeling Receipts are Worth Money

First of all those remodeling receipts my have some warrantees that my extend for years to come like a furnace, hot water tank, and appliances, especially when extended warrantees are purchased.

Other major remodels like the Roof, Siding, and Windows may have long term warrantees from 10 to 25 years, or Lifetime warrantees.

I've added a photo (above) to this question to show how I keep receipts in separate categories in a ledgered envelope for safe keeping.

One or a couple envelopes for remodeling your home (for other's an investment house) is easily kept separate from all other receipts.

Notice that the envelope fits in a 3-ring binder.

There are larger ledger envelopes that fit in a standard 3-ring binder too.

So keeping those remodeling receipts are easily kept when separated from all other personal or job related receipts for tax returns.

Why Keep Those Receipts?

1) Someday, all properties are sold and it may be profitable to show a buyer all the work we did on our homes and how we took care of them.

2) "Cost Basis" for Capitol Gains earnings on Your tax return.

a) Add the purchase price of your home, Plus, add all the remodeling costs, equals, the total cost "cost basis", you paid for your home.

b) The Sale price of your home, minus, the cost basis you paid for your home is your Profit. On real property, that profit is taxed as capitol gains instead of income-tax.

c) By reducing your taxable profit, from including your remodeling expenses, many times add up to thousands of dollars of taxes Saved.

Note: Currently in the USA there are tax exemptions on capitol gains on your primary residence.

(Check with your licensed tax professional for the details, I'm not a CPA.)

I'm guessing, I think the ceiling was at $250k for a single person and $250k for married tax filers.

3) A Quicker Sale...

My story of buying a used truck from a private seller...

While shopping for trucks some guys would tell me about all the work and maintenance they did on their trucks. I think some of them were stretching the truth a bit. They made it sound good and want to make the sale and get as much as they could get out of me.

Then I meet the guy who simply handed me his envelope with all the receipts; the oil changes, new breaks, new radiator, new air conditioning, new exhaust, new transmission, etc.

He didn't have to try to tell me anything, or try to sell me on it being a well maintained truck. He simply proved it with his receipts!

That's the truck I bought!

Same thing works when selling a house.

One Last Tip

I keep a full size binder just for my home.

I keep a separate binder for every house I buy.

*** Everything In One Place ***

In that binder I keep:

1) The receipts (of course), but There Is More...

2) The Property Tax Receipts

3) A list of Contacts from the purchase, and emergency phone numbers for repairs and warrantees.

4) Anything I get that is related to what's going on in the area

5) Emergency number like: Police, Hospitals, Schools, City Services, the Utility Companies, etc.

6) Insurance Policies

7) Copies of the Deed and Title Insurance

In other words, anything to do with Your home is all in one little binder for easy and quick reference.

Okay, I know you said this was for your home, But...

Could you Imagine?

If you decide to buy an investment house, a cottage, or a second home someday...

A little bookshelf with 2, 3, or 10 binders that each contained everything needed to access all the information about your house(s).

If Ever We Need Help from Someone While Sick (or whatever - you know)

In my case, if anything happens to me, my wife Lori will have Fast Access to everything she will need about our home in one, simple, at-a-glance binder.

Hope this helps you out some with your decision :-)

If you or anyone would like to add to this, please go ahead and click on the link below. Thanks

Comments for Remodeling my own home (not investment) and receipts

|

||

|

||